- The Cartograph Newsletter

- Posts

- Cartograph January Newsletter

Cartograph January Newsletter

Amazon fee updates, 2025 reflections and 2026 predictions from the Cartograph team

A note from our CEO

Happy New Year everybody!

2025 was a volatile year in consumer. It was super easy to get distracted. As the year came to a close, we reflected on all the different directions we’d been pulled in, and concluded the best thing for us to focus on for 2026 was….focus itself! So this year, we’re focusing on what made us successful in the first place – getting wins for our clients on Amazon, celebrating those wins, and learning from each other so we can win as a team.

On Amazon, those wins come from combining innovative strategies and ideas with sustained, disciplined execution and performance. We do that by ensuring our fundamentals are strong and by being aggressive, creative, and opportunistic around your catalog, category, and Amazon’s new features.

With every year, Amazon gets a little harder: ads get more expensive, and a larger number of your competitors are executing well on the platform. Ensure your fundamentals: inventory, content, advertising, promotions, and reviews are strong. Find small edges in your product assortment, category trends, and new Amazon. Like a basketball game - it’s won in consistent production over dozens of possessions, not one big shot.

Below you can see how our themes for the year refocus us on fundamentals of performance, growth, and great client service. We’re entering year 8 with a focus on the thing we’ve always done best: Amazon for CPG.

In this month's newsletter, you'll find:

Cartograph’s themes for 2026

Amazon 2026 fee updates

2025 reflections and 2026 predictions from the Cartograph team

The latest search term trends

Feel free to reply direct - it goes to my inbox!

Know Amazon, know ball,

Chris

Last Month’s Sales and Ad Spend Numbers

Cartograph’s Themes for 2026

Reminder: Amazon 2026 Fee Updates 1/15/2026

Amazon is making several meaningful changes to FBA fees starting January 16, 2026. They’ll show up directly in pricing, inventory strategy, and margin planning.

FBA fulfillment fees will now factor in item price, not just weight and size.

That means small pricing moves around key thresholds (especially ~$10 and ~$50) can materially change unit economics.Low Inventory Level Fees are shifting to the child ASIN level (with grocery exempt).

This makes variant-level forecasting more important. One understocked SKU can now trigger fees, even if the parent ASIN looks healthy.Aged inventory fees are getting steeper.

Fees double at 366 days and increase again after 456 days, putting more pressure on sell-through discipline and lifecycle management.

2025 Reflections & 2026 Predictions from the Cartograph Team

2025 in Review:

From: Michael Stephens

|  |

From: Chris Moe

|

|

2026 Predictions

From: Justus Mai | Amazon will continue to tighten down on FBA Inventory and squeeze sellers. This year we saw:

From my perspective, Amazon seems to have an internal goal of becoming more efficient with their inventory space/planning. Great for them, but it puts a lot more pressure on sellers. |

From: Michael Stephens | Amazon will launch a new ad placement. “Sponsored Answers” that show up inside Rufus. |

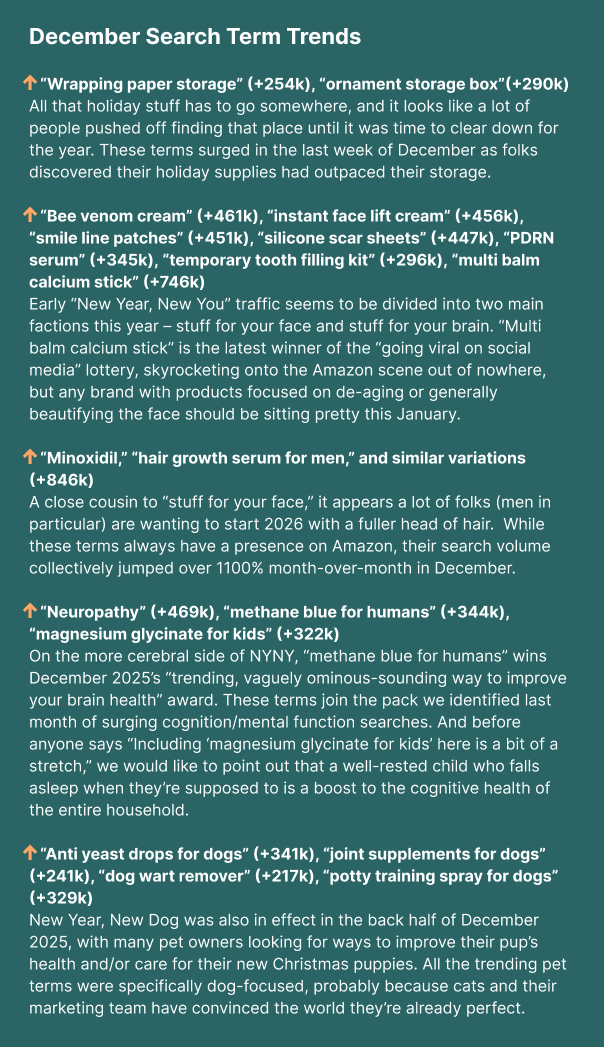

Search Term Trends

Each month, we track and analyze search volume and CPCs for popular Amazon search terms. Here are some recent trends from the last month that we found interesting.

Note: The numbers in parentheses next to each search term indicate the month-over-month increase in search volume on Amazon.