- The Cartograph Newsletter

- Posts

- Cartograph July Newsletter

Cartograph July Newsletter

All things Prime Day — from data and insights to what brands should be doing now post-event, and how to start preparing for October Prime Day.

A note from our CEO

Hey everyone,

Happy July! We just had Prime Day, which was oddly held right after the 4th holiday. The 4th weekend is always one of the slowest shopping days of the year. Pair this with massive ad campaigns about Prime Day pushing traffic to Amazon, and you have a tougher week for having your biggest sales of the year.

Prime Day was also extended to 4 days, up from 2 days the past few years. We think this was done to compete with other retailers trying to front run Amazon deals, as well as get ahead of the (now postponed) tariff deadline of July 9.

The data is in, and between Amazon and other Amazon service providers, the story is pretty clear: the 4 days of Prime Day 2025 slightly outperformed the 2 days of Prime Day + the 2 non-days of Prime 2024. Most outlets quote between 5-10% from in-year baseline.

While Amazon has tried to spin this as a triumph, I view it as a pretty soft result. Twice as many days of promos and twice as many days of higher cost ads resulted in slightly higher lift across 4 days. I hope they revert to 2 days next round. Or, we’ll try to play primarily Day 1 and Day 4. We’ll see.

Nonetheless, many of our brands have continued to grow into record months in both June and July. The better-for-you consumer has remained resilient event amongst the economic uncertainty, which is fortunate compared to many other sectors.

In this month’s newsletter, you’ll find:

• Our latest portfolio sales and ad spend index

• Data, insights and takeaways from Prime Day

• A look ahead to the rest of 2025 on Amazon

• How we helped Mosh bulk up their Amazon business

• Latest Amazon search term trends

Feel free to reply direct - it goes to my inbox! And if you enjoy this newsletter, feel free to pass it on to anyone who might find it helpful.

More Time, Less Prime,

Chris

PS - we are hiring! We’re looking for folks for Amazon brand management and b2b Cartograph marketing and sales roles. Please let us know if you would like to see a job description, or send us resumes!

Last Month’s Sales and Ad Spend Numbers

Data, Insights and Live Takes from Prime Day

It was a weird Prime Day, to say the least.

Bloomberg’s headline said it all: “Amazon Prime Day Sales Plunge 41% in First Day of Four-Day Event.”

The conversation that followed was a mix of rationalizations:

→ “Don’t compare 2-day events to 4-day events.”

→ “This baseline is off.”

→ “YoY is broken.”

But the tone said more than the numbers. It just didn’t feel like a win.

Yes, our portfolio was up big YoY. And yes, some brands saw 5-10x daily sales lift.

But compared to 2024, average daily performance felt softer. CTRs were down. Urgency was muted. And with a four-day window, shoppers took their time.

Here’s what we saw across the portfolio and what we’re learning from it:

1. Timing and pacing made all the difference.

Some of our brands saw significant portions of total sales come after 5pm. For both the U.S. and Canada, evening hours carried the lift, but only for brands that saved budget to capture it.

2. Day 2 and Day 3 weren’t dead.

They were down 40-60% from Day 1, but still beat typical daily sales by 2-4x. Some brands pushed 8-10x lift even on “off” days.

3. Day 1 and Day 4 were the bookends to watch.

Conversion rate peaked early, dipped mid-event, then rebounded hard as urgency returned on Day 4.

4. New customers showed up.

Many brands saw 20-50% of sales from new-to-brand (NTB) shoppers. Prime Day is still a strong acquisition window, especially for hero SKUs.

5. External activation worked.

Brands that paired Prime Day with high-intent social and email saw materially better results. Influencer launches, SMS boosts, and strong DTC offers helped drive performance.

6. CPCs were up.

Ad costs spiked as high as 60-100% above average in some categories. The fight for top-of-search was real, especially for category terms, and branded went up in cost too.

7. Even full-price SKUs saw a lift.

Several brands saw 2-3x baseline sales on products without any Prime Day promos. If traffic is high, placement and relevance still matter.

8. Amazon’s color shift raised eyebrows.

The app was styled in Walmart-blue, not Prime-blue. Unclear if it impacted behavior, but it didn’t go unnoticed.

9. Reference pricing rules kept causing problems.

Brands without strike prices set >30 days out missed eligibility. The issue wasn’t new, but it still hurt.

10. Deal visibility issues cost time.

Early tech glitches delayed launches for some. Amazon resolved them fast, but lost hours during peak traffic windows.

Final takeaway:

This year’s Prime Day may not have been a blockbuster, but the traffic was real, the intent was real, and for brands that showed up well, the growth was real too.

What to Do After Prime Day, And How to Prep for October

Now is the time to plan inventory for October Prime Day, likely mid October.

Part of that is making sure you have enough FBA Capacity. Your September Capacity should be large enough for inventory to be in for all of October Prime Day.

Why? Because last year, inventory for October Big Deals Day (i.e. October Prime Day) had to arrive at Amazon FCs by September 13th. As of now, we’re projecting a very similar mid-September date for October Prime Day this year.

Here are some tips for riding the July Prime Day wave through the summer and preparing for the next big sales event in the fall.

Shoutout to Ginny Chochon, Justus Mai, Glynn Kaplan and rest of team for their contributions here.

Post-Prime Day: Keep the Momentum Going

Follow up with your Prime Day audience

Many customers browsed, added to cart, or even bought, but didn’t stick. Re-engage them with follow-up ads and emails:Target people who viewed product pages but didn’t purchase.

Reach shoppers who added items to cart but never checked out.

Focus on first-time buyers from Prime Day with tailored second-purchase offers.

Use promotions to nudge a second purchase

Coupons still work, especially when they’re specific. In one case, we saw a 23% redemption rate from coupons aimed at Prime Day buyers.Test loyalty formats like Subscribe & Save

For replenishable products, recurring formats are a natural fit. Promote S&S with a small discount to keep one-time buyers coming back.Extend your run with seasonal placements

If your product plays into themes like “Back to School” or “Self-Care Under $50,” you can stay visible without needing another tentpole event.

October Prime Day: What We’re Planning for Next Time

Don’t wait until noon

Some brands saw their strongest velocity in the early morning, and lost traction when campaigns ran out of budget by 10 a.m. Front-load your ad budget and pace it across key conversion windows. Late in the day is often strong as well.Bring in off-Amazon support

Sales and ROAS improved in the evenings when email, SMS, and influencer pushes went live. Coordinated external pushes matter.Expect higher CPCs and adjust quickly

We saw 60-100% increases on branded and category terms. Have a real-time budget plan and be ready to adjust bids hourly.Official Prime Day Deals beat regular discounts

PEDs outperformed standard coupons. If you're not using PEDs, stack Subscribe & Save or tiered promotions to mimic the urgency.Bundle for exposure

Some brands gained best-seller tags by grouping mid-tier SKUs with top performers. Variation strategy matters.Know your strongest days

Day 1 and Day 4 typically led the pack. Days 2-3 were slower. Build campaign strategy around a strong open and close.

How Mosh Turned a Shark Tank Spike into Sustained Growth

Hot off their breakout moment on ABC’s “Shark Tank,” Mosh came to Cartograph looking for a path to durable, year-round performance. Together, we helped them double ad spend without tanking CVR, scale Subscribe & Save, and unlock full-funnel efficiency through better creative, smarter spend, and AMC-powered insights.

It’s still one of the sharpest executions of STV + NTB strategy we’ve seen.

Key Takeaways:

+58% YoY monthly revenue growth while holding a strong 12.5% CVR.

+175% YoY increase in new-to-brand (NTB) customers.

Used Amazon Marketing Cloud to prove full-funnel effectiveness and guide ad and offer strategy.

Read the full case study here: https://www.gocartograph.com/case-studies/mosh

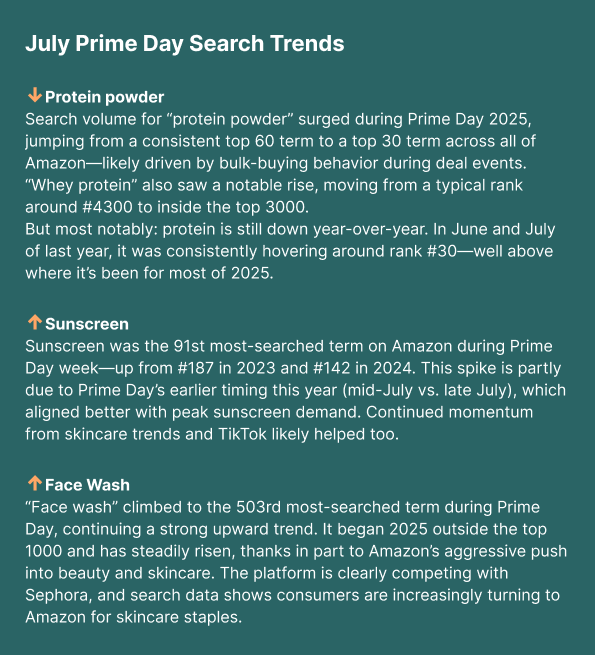

July Prime Day Search Trends

Each month, we track and analyze search volume and CPCs for popular Amazon search terms. Here are some recent trends we found interesting.